By Steve Dickman, CEO, CBT Advisors

Note: A shorter version of this piece ran on Xconomy.

The pharmaceutical industry needs better scientific models for testing drugs before they get to the proving ground of human clinical trials. Current lab dish models and animal testing models are time-consuming, expensive and chronically unable to predict which drugs are going to work in clinical trials. The industry is crying out for new modes of early testing that can shorten the timelines, reduce the cost and increase the odds of success in clinical trials.

Both lab dish models and animal models have run into serious limitations. Cell culture (“in vitro”) assays offer some real advantages. Many can provide true, “human” answers to fairly simple questions. But they lack complexity.

Therefore, due both to regulatory requirements and convention, pharmaceutical companies have for decades progressed their testing from cells into animals, where the testers can see the impact on an entire organism with all its interconnecting systems.

But animal models are in some ways even worse. As Dylan Walsh pointed out in his timely New Yorker blog post last week, most animal testing – the kind done in rodents – is crude and ineffective, not to mention how it feels for the mice.

The cosmetics and consumer products companies are in just as tough a bind. For them, safety is paramount but animal testing has been banned as of 2013 for products marketed in Europe and soon to be eliminated in China. If non-animal models that show safety became available, then L’Oreal, Proctor & Gamble and Unilever would be queuing up to use them.

Fortunately, the reliance on this unfortunate patchwork might be about to crack. If cell models could be shown to predict efficacy in a reliable way, ineffective therapeutic candidates would fail faster – and cheaper. Better safety testing would drastically reduce the sacrifice of animals while yielding more predictive results. Here, though, any changes there would likely take many years due to the immense difficulty of making regulatory agencies like the US Food and Drug Administration comfortable with new regulations.

In fact, futuristic models are beginning to appear. Walsh’s New Yorker post features Harvard luminary Don Ingber, who has been working, organ by organ, on establishing better in vitro models since the founding of his Wyss Institute (the delightful full name of which is the “Wyss Institute for Biologically Inspired Engineering”). His strong academic work in sophisticated in vitro tissue engineering reaches back to the early 1990s. As Walsh writes, “Recent efforts have led to fully functioning “organs-on-a-chip,” named with a nod to their roots in microchip manufacturing. A critical and deceptively simple benefit of these organs-on-a-chip is that they simulate, in a rudimentary way, the mechanical motion essential to organ function.”

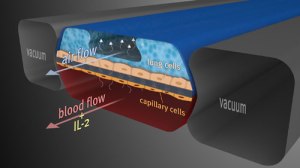

Ingber’s lab is in the lead in this area, especially in lung models. I wrote about Ingber’s work here in 2010. Walsh writes:

“The physical mechanics of organs-on-a-chip—the lung-on-a-chip can “breathe” like a normal lung—provide an essential advantage over inert cells grown in a petri dish. For instance, in a recent experiment conducted by Ingber’s lab, when a set of the lungs-on-a-chip that could “breathe” were dosed with the cancer medication interleukin-2, they were afflicted by a well-documented side effect of the medication in humans, severe pulmonary edema; only mild symptoms appeared in a model of the lungs-on-a-chip that didn’t breathe. ‘We’ve ignored mechanics for a century,’ Ingber said.”

These single-organ models are impressive. In October, 2013, the Wyss Institute signed a collaboration at undisclosed terms on the development of human and animal “organs-on-chips” for safety testing.

In some cases, less sophisticated models in tissues such as liver and skin have already become industry standards. I wrote about these models, and the likely future of this field, here in 2009.

Europeans take the lead

More ambitious models are on the way. A US government initiative, which was showcased in an invitation-only symposium in Europe in September, 2012, recently put up $140 million to develop a network of ten “plug-and-play” organs that survive for four weeks and can, like Legos, be easily rearranged in different orders.

The effort by NIH and DARPA to address European product developers – and get an update on their progress – was done with good reason. As Walsh’s post mentions in a brief aside, there are a few efforts from “a handful of labs worldwide [that] have so far constructed a system with more than one organ.”

One of these is in Berlin, Germany, where the company TissUse, a CBT Advisors client, is pioneering perhaps the most advanced of these efforts. Recognizing that the secret to mimicking complex biology in culture lies in a combination of organ architecture and live circulation, TissUse, spun out of Berlin’s Technical University in 2010, has built its platform around organoids, the minimal functional units of organs. These include liver lobules, skin segments, kidney nephrons and the lining of the intestine. They might eventually include pancreatic islets, where insulin is produced. These organoids can be bathed in appropriate nutrients, and have waste products taken away, at the same scale at which they are served by capillaries in the body. Scale is extremely important in biology. This effort to mimic the natural scale of organ biology makes the TissUse system both robust and modular.

It’s not a perfect analogy, but organoids can be thought of as similar to the transistors that started to replace vacuum tubes in the 1950s. Transistors made modern electronics – laptops, mobile phones, tablets – possible. Similarly, organoids open up vast possibilities. The technologies for first creating them and then packing them optimally onto chips are still in their infancy.

Putting multiple tissues – with all or most of their attendant cell types – into culture and connecting them with tiny “blood vessels” in a physiological order – first intestine and liver than all other organs – will require a virtuoso combination of architecture, engineering and biology, all done at micro (not nano) scale. No wonder we have not been able to find more than a couple of companies that are talking publicly about their work on the topic.

Besides TissUse, the most advanced company that we found to be working on multi-organ models is Hurel, founded in 2006 by Michael Shuler of Cornell University. Hurel raised Series A funds from hedge fund Spring Mountain Capital in April, 2013. The Hurel web site talks about “products under development for future release” that involve “fluidically mediated metabolic interaction of different cell-based models drawn from or representing different bodily organs, such as liver-with-heart and liver-with-kidney combinations.” (Shuler’s January, 2013, review article on lab-on-chip systems including those incorporating several organs is here, behind a pay wall. None of these efforts appear to be company-led.)

Hemoshear of Charlottesville, Virginia, has set an emerging industry standard for “vascular pharmacology” by including the impact of dynamic blood flow on cells in culture. Founded in 2008 out of the nearby University of Virginia, Hemoshear was reported in 2012 to have ten biopharmaceutical industry customers. The company puts cells of different organs, most recently liver, into their dynamic systems that push blood past the liver cells. That allows them to get a high-quality look at liver toxicity, drug metabolism and drug-drug interactions. Aside from the useful combination of different organs with vasculature, the company has not reported multi-organ approaches, let alone organoid-based ones.

Another interesting one is Zyoxel, based in Oxfordshire in Great Britain. Zyoxel was founded by Zhanfeng Cui of the University of Oxford based on technology from Cui’s lab and the lab of Linda Griffith of MIT. The Zyoxel chip is liver-only. That is the single-organ focus of many in vitro testing companies that have created “3D liver” systems. According to the web site, the Zyoxel chip’s key distinguishing feature is “a scaffold whose dimensions have been engineered to recreate the capillary bed structure of the liver sinusoid.” That approach sounds promising and it will become even more so once scientists have actually shown that they can grow the capillaries on the chip.

Eleven organs – the true “human” on chip?

By comparison, the science at TissUse is both advanced and extremely ambitious. The early TissUse chips feature a combination of organs, liver and skin, connected with channels that circulate culture medium and, soon, human blood that moves through “vessels” comprised of endothelial cells that will grow directly inside the channels.

Liver and skin were chosen in part because they are the most complex single-organ systems currently in use in vitro. Moreover, liver is the gatekeeper for oral drugs entering the bloodstream and skin is the gatekeeper for cosmetics. TissUse is tying them together both because the company has strong expertise in both but also because they can create some interesting and useful models with them, for example, models that allow them to study potential liver toxicity of skin-penetrating chemicals or skin sensitivity to liver metabolites of drugs. Furthermore, such a combination allows TissUse to study distribution, metabolism and toxicity, three components of the “ADMET” profile of a substance, which is the basis of current safety testing in animals. “ADMET” stands for absorption, distribution, metabolism, excretion and toxicity.

TissUse’s two-organ chip. Photo courtesy Tissuse GmbH

Used singly, both liver & skin have severe limitations. TissUse is trying to remedy these. Most of the company’s work is not yet published but one observation is that liver cells, when encouraged to form organoids and then combined with skin tissues, can live in homeostasis for a long time. This allows the company to conduct extended repeat-dose testing over weeks, much longer than the current standard of several days for single-dose drug testing on liver or skin cell culture routinely performed today in industry. The practical time limit for culturing liver organoids in the TissUse system has not yet been reached. Early published results point to a time frame of at least 28 days.

The powerful nature of TissUse’s system becomes evident when you consider the next step: to test “A” and “E,” adsorption and excretion, all you have to do is add intestine and nephrons from the kidney. The company is already working on doing just that. Eventually, TissUse’s founder-CEO Uwe Marx envisions up to eleven organs connected by “blood vessels” on the company’s chips. The initial chip design takes that goal into account.

Head-to-head data is starting to emerge comparing multi-organ chips with standard efficacy and toxicity assays. That will prove their predictive ability. Such a system will then address industry’s need for verisimilitude in therapeutics and cosmetics testing without sacrificing animals or accuracy.

The future human-on-a-chip? Image courtesy TissUse

“You on a chip”?

Another level of utility not yet addressed by TissUse but surely on the horizon is patient-specific testing of medications outside the body using iPS cells (inducible pluripotent stem cells). Scientists create these cells from human skin or other tissues and “reprogram” them to become cells of almost any tissue. Companies such as Cellular Dynamics in Madison, Wisconsin, are already beginning to deliver large quantities of iPS cells on an industrial scale and with pharmaceutical quality controls in place. In my view, that source of supply alone is a game-changer for drug testing. The company had a surprisingly strong IPO given the “picks-and-shovels” nature of its business, probably because its revenues are growing nicely. It won’t be long, I predict, before innovative companies start to offer outside-the-body testing especially for patients with chronic or long-term diseases who can therefore afford to wait to have their cells custom-grown.

But without the multi-organ and organoid-based nature of TissUse’s technology, it is hard to see that patient-focused business reaching its full potential. Indeed, a company called iPierian backed by the illustrious US venture firm Kleiner Perkins and other top VC firms was founded in part to industrialize just such iPS-cell-based, patient-centric disease models. I heard iPierian’s then-CEO John Walker describe this approach a talk at an investor conference in 2010 and it was captured in this 2010 blog post on Xconomy by Luke Timmerman. That company has since changed its business model and I have not heard of others.

Forward-minded venture investor Founders Fund of San Francisco laments the “medieval” approach used in traditional pharmaceutical discovery. The right sources of capital combined with the right industry partnerships, both currently emerging, might give Hurel, Hemoshear, Zyoxel, TissUse and other companies a path to preclinical testing that is both more accurate and more humane.

# # #

Disclosure: TissUse is a client of CBT Advisors.